SB 54 Could Put Lighting Manufacturers on the Hook for Additional Funding

If you think the ban on single-use plastic drinking straws (effective in 8 states and growing) is merely a consumer annoyance, you may be missing the bigger picture.

Those who do not live or do business in California might be unaware of the SB 54 Plastic Pollution Prevention and Packaging Producer Responsibility Act, which was passed in July 2022. Proposed as a solution for reducing waste by eliminating certain forms of single-use plastics and packaging (such as plastic straws and Styrofoam take-out containers), SB 54 was drafted with the best of intentions. Its implementation, however, faces significant challenges — some of which might negatively impact lighting manufacturers, retailers, and consumers.

Rachel Michelin, President of the California Retailers Association and a member of the Advisory Council for SB 54, detailed her concerns at the latest American Lighting Association’s (ALA) membership forum this month. The California Retailers Association’s mission is to promote, preserve, and enhance the retail industry in that state, similar to ALA’s commitment to the decorative residential lighting community as a whole.

As the lighting industry has experienced with past legislation – most notably regarding incandescent and fluorescent light sources – regulations that originate in California often take hold in other states across the country.

While it might seem like food service items have little to do with lighting, when you consider the types of packaging that manufacturers use to ship lighting fixtures – such as various foam and corrugated materials – the connection becomes clearer. Of particular concern is the unintended result from reducing the amount and weight of packaging material; specifically, that the rate of breakage during shipping will increase.

Michelin expressed concern that the cost of funding this endeavor – typically shouldered by government entities – will be pushed onto the manufacturers, which will then necessitate price increases that could be passed onto the distributor and ultimately the consumer.

At the time that SB 54 was proposed, California was enjoying a budget surplus, Michelin explained.

Since then, however, California has been wrestling with an enormous budget deficit with no relief on the horizon.

“I think there should be shared costs, but from a business perspective, I think we have to consider whether this is sustainable and, most importantly, the impact it could have on consumers,” she remarked.

Instead of the recyclers or government handling the costs of the program (which is typical), the latest iteration of SB 54 is for the “producers” to bear a significant responsibility in managing and funding the waste collection, recycling, and disposal program.

Who are “producers” and what are “covered materials?”

In SB 54, “producers” is a broad term that includes manufacturers, and potentially private label retailers and distributors, who use what is listed under SB 54 as “covered materials.”

Those “covered materials” involve single-use packaging that is discarded and not reused. While the initial verbiage centers on “single-use plastic food service ware,” it is likely the criteria for materials will be expanded to include packaging used in shipping lighting fixtures and other products.

As the state of California is home to a number of commercial and residential lighting manufacturers, some of which have domestic manufacturing and shipping operations on-site, SB 54 can have a negative impact on their business costs. In addition, it is assumed that products warehoused in California will also be under this directive.

The full list of “covered materials” will be released on July 1.

Where do we go from here?

SB 54’s “extended producer responsibility (EPR) program” is under the direction of California’s Department of Resources Recycling and Recovery (CalRecycle), which handles the state’s recycling and waste management programs.

CalRecycle has begun formal rulemaking activities regarding SB 54 and held a 45-day public comment period and public hearing in April. CalChamber, along with the American Lighting Association, submitted their concerns during that timeframe for consideration.

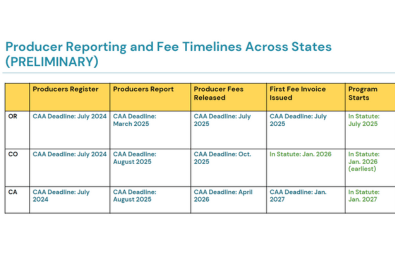

Under most U.S. EPR laws, a PRO (Producer Responsibility Organization) is involved. This type of non-profit organization provides producers with compliance services to help them meet regulatory obligations. One such organization is the Circular Action Alliance (CAA), which was founded by 20 well-known companies from the food, beverage, consumer goods, and retail industries (Amazon, The Clorox Company, The Coca-Cola Company, Colgate-Palmolive, Target, Walmart, among others) in response to the passage of EPR laws in California, Colorado, Maine, and Oregon. CAA is the first PRO approved to administer an EPR program for paper and packaging in the U.S. and is seeking to be an approved PRO in all states that have enacted EPR laws for paper and packaging.

Companies that will be affected by SB 54 can join CAA at no cost prior to July 1. Failure to register with CAA (if applicable) in a timely manner will ultimately result in fines.

Further complicating matters is California’s upcoming state budget talks. Two weeks ago, Governor Gavin Newsom released a summary of the May Revision to his proposed 2024-25 California state budget, projecting a $44.9 billion shortfall (or a $27.6 billion shortfall, if counting early budget action taken by the legislature in April). The governor is proposing to close the budget gap through the partial use of reserves, spending cuts, and delays or deferrals of spending authorized in earlier years. While SB 54 was not specifically mentioned, spending cuts could possibly prolong the timeline for SB 54 compliance or shift the financial burden. The California state budget will be announced by June 15.

“This is going to be an interesting next couple of months and next couple of years,” Michelin remarked. For example, will producers have to pay more into the PRO to alleviate the state deficit? “Those are questions that are going to have to be asked as we go through this process,” she said.

“Representing the retail industry, we have environmental sustainability goals, too,” Michelin stated about her organization. “We’re not against what they want to do in this space. The challenge is, how do we make sure [SB 54] works effectively and doesn’t put undue burden on consumers and our businesses? We don’t want these costs to spiral and impact our consumer base. In the end, I hope [after the discussion process] we’ll be able to come out with something that meets everyone’s goals, but in a way where we can be successful.”

As the compliance deadline stands now, at least 30% of a producer’s packaging has to be recyclable on or after January 2028, at least 40% by January 2030, and 60% on or after January 2032.

Michelin’s advice to ALA’s manufacturer members is to look closely at the covered materials list that will be released on July 1, identify the items that are unique to lighting, and bring those concerns to the attention of CalRecycle. “I think part of the challenge is that – and I find this in the retail industry in particular – is that they [governing bodies] don’t understand some of the nuances of some of the products being sold and some of the innovations that we’re trying to do in the retail space when it comes to shipping,” she explained. “We need to do a better job of educating them so that they understand the unintended consequences and what sort of impact that’s going to have on the consumer.”

There will be an upcoming opportunity to make the lighting industry’s voice heard when CAA will be performing the Needs Assessment for California over the next several months.

For more information about SB 54, click here

To learn more about the Circular Action Alliance, click here