Why Lighting Reps Carry So Many Lines: Understanding the Multi-Line Strategy in Today’s Market

By Geoffrey Marlow, Marlow Advisory Group

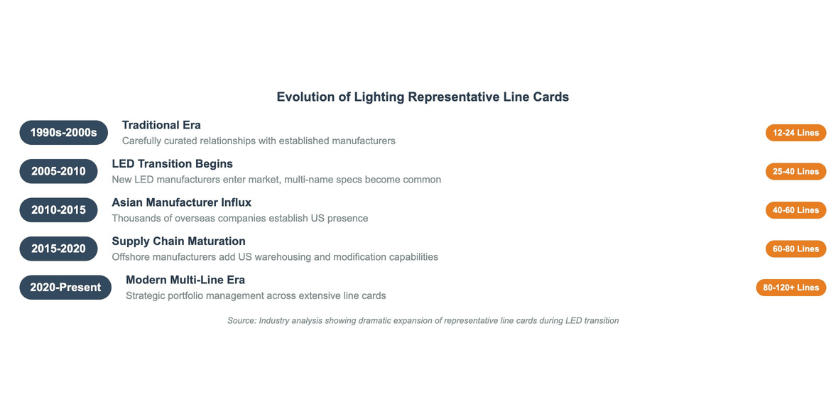

Where lighting representatives once carried a couple of dozen carefully curated manufacturers, today’s reps routinely represent 80, 100, and even 120+ product lines. This expansion reflects calculated strategic responses to fundamental industry changes driven by evolving specification practices, risk management needs, and complex channel dynamics.

The Multi-Name Specification Revolution

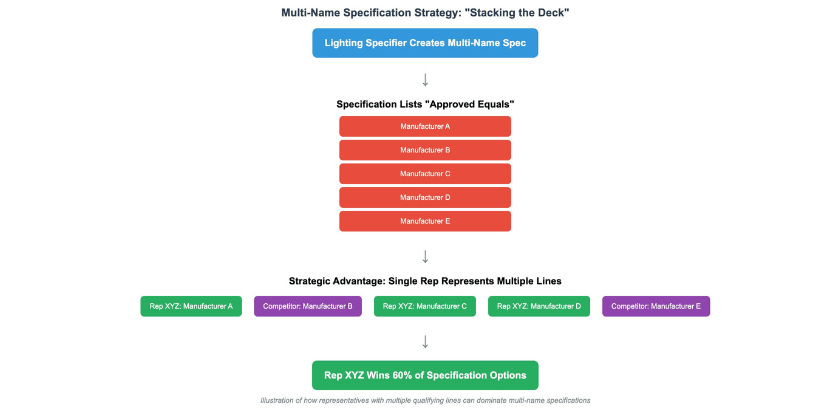

The foundation of multi-line strategies lies in widespread adoption of multi-name specifications in project business. Multiple-name specifications are used when several available products meet the design, performance, and budgetary requirements of the project or application, fundamentally changing how lighting projects are bid and procured.

Requirements for multi-name specifications multiply the workload of the specifiers, who must evaluate many manufacturers’ product lines and determine which competing products are equal. Being excluded from specifications often means being excluded from projects entirely.

However, multi-name specifications can work strategically in representatives’ favor when managed effectively. Sometimes the best specification that an agent can write is one where they are allowed to list themselves five times — representing multiple qualifying manufacturers within the same multi-name spec. This allows representatives to essentially stack the deck in their favor, dramatically increasing their probability of project participation regardless of which option ultimately gets selected.

Yet multi-name specifications create additional complexities: often the “equals” allowed aren’t equal at all. This gets compounded as channel dynamics unfold during bidding, with electrical distributors and electrical contractors evaluating alternatives and seeking approvals for substitutions, with customers not fully understanding the fundamentals of original fixture selections (understandably) and often granting blanket approvals to deliver cost savings based on distributor and contractor recommendations. These natural market forces can affect design intent while representatives with broader line cards are better positioned to participate throughout these channel processes.

Supply & Demand Imbalance: A Seller’s Market for Representation

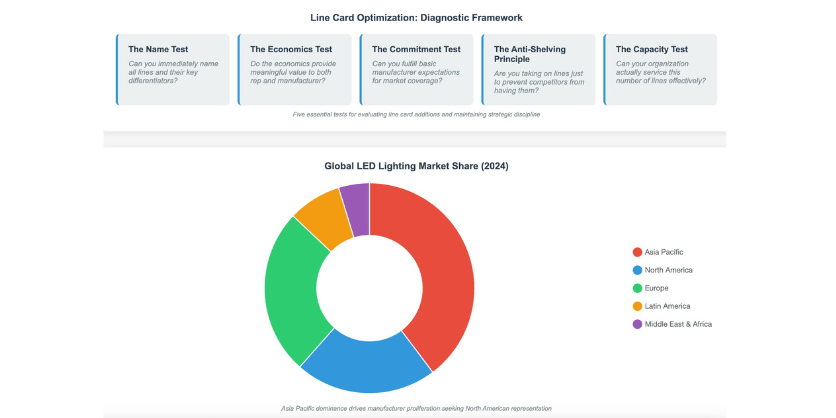

The lighting industry has experienced consolidation that has reduced the number of quality representatives, while the number of manufacturers seeking representation has grown dramatically. A significant driver has been the exponential growth in lighting manufacturers serving North America during the LED transition of the last decade. China is the largest manufacturer and consumer of LED products worldwide, with Asia Pacific dominating the LED lighting market with 39.72% market share in 2024.

The LED revolution fundamentally changed manufacturing, enabling thousands of new companies – particularly from China and other Asian countries – to enter the North American market. These manufacturers offer competitive pricing, often 20 to 40% lower than traditional North American brands, while providing extensive product ranges and modification capabilities.

Many of these offshore manufacturers are now warehousing in the U.S., with many offering in-house modification capabilities — services once the exclusive domain of U.S.-based manufacturers. This local presence enables them to provide faster delivery times, responsive customer service, and modification options that rival or exceed traditional domestic suppliers, further intensifying competition for representative attention.

This supply-demand imbalance means successful representatives field constant inquiries from manufacturers seeking representation. Even with high selectivity, line cards naturally expand. The mathematics are simple: if a representative receives 50 requests annually and accepts only 10%, their line card still grows by five manufacturers per year.

The Line Card vs. Sales Talent Philosophy

Parallel to multi-name specification trends runs a fundamental business philosophy: building comprehensive line cards is often more achievable than developing exceptional sales talent. The complete sales professional – capable of managing the full arc from opportunity ignition through flight control to landing – represents a rare, expensive, and difficult-to-develop resource.

Building comprehensive line cards creates a “market magnet” strategy where business flows to representatives positioned as comprehensive resources. When specifiers, contractors, and distributors know a representative can address virtually any lighting requirement, this approach reduces skill requirements for individual team members while increasing market coverage.

However, the secret sauce lies in combining both elements: exceptional sales talent supported by comprehensive line cards. This creates multiplicative value where skilled professionals leverage comprehensive product offerings to maximum advantage.

Profit Optimization & Strategic Management

Multi-line strategies enable sophisticated profit optimization through various price points, commission structures, and overage arrangements. An underutilized strategy is strategically directing margin dollars to manufacturers most deserving — those with the strongest commitment to customers through product support, industry support, representation support, and service support. Manufacturers that make opportunities repeatable, controllable, hassle-free, and profitable through a customer-valued offering should be rewarded with focused sales efforts.

Today’s market demands unprecedented solution variety across multiple dimensions: price options from value-engineered to premium specification-grade products; lead time variations when supply chain constraints become critical; and quality tiers spanning the entire market spectrum.

Channel Dynamics & Specification Realities

Modern specifications rarely contain absolute requirements. Reps, distributors and contractors all have financial incentives to change specs, and representatives with broad line cards are better positioned to participate in post-specification negotiations and value engineering exercises. Industry research indicates that even when representatives succeed in getting new products specified, the chance of those products actually being installed is often around 50%, demonstrating how fluid the construction process truly is in practice.

Professional specifiers expect representatives to serve as comprehensive resources across the full spectrum of lighting applications. The challenge lies in maintaining deep technical knowledge across increasingly diverse product portfolios while meeting rising expectations of sophisticated design professionals. Ask channel participants to identify the five most important qualities when selling and selecting a product — the number they highlight and the order they present them can be very revealing.

The Critical Balance: Strategic Curation vs. Overwhelming Accumulation

While market forces drive toward broader line cards, there exists a critical inflection point where more lines become counterproductive. The line should be drawn where focused commitments to manufacturers can no longer be met due to overwhelming distractions.

True sales expertise requires deep understanding of each line’s value proposition versus simple option presentation. Representatives who resort to “Do you want this, or do you want this?” conversations build value for no one.

Essential diagnostic tests for line card optimization

The Name Test: If you can’t immediately name all lines and their key differentiators, you lack sufficient bandwidth for effective representation.

The Economics Test: If economics provide no meaningful value to representative or manufacturer, the relationship lacks sustainability.

The Commitment Test: Can you fulfill basic manufacturer expectations for market coverage and sales development?

The Anti-Shelving Principle: Reject taking on manufacturers simply to prevent competitors from representing them. If you can’t actively use and sell a line, you shouldn’t represent it. Fear of competitors indicates deeper sales effectiveness issues that cannot be solved through defensive line accumulation.

The Capacity Test: Can your organization actually service the number of lines you’re considering? Each additional line requires dedicated resources, and over-extension leads to diluted performance across the entire portfolio.

Conclusion: Strategic Discipline in Portfolio Management

The multi-line strategy serves multiple purposes: risk mitigation, profit optimization, comprehensive solution capabilities, and enhanced channel relationships. However, optimal strategy requires careful balance between diversification and focus.

The most successful representatives understand that strategic discipline in line selection often creates more value than maximizing line count. Quality manufacturers prefer representatives who can dedicate appropriate attention to their programs rather than those treating lines as commoditized catalog options.

As the lighting industry continues evolving, representatives who strategically curate multi-line approaches – balancing market coverage with focused execution while developing both exceptional sales talent and comprehensive product portfolios – will be best-positioned for sustainable competitive advantage.

The question today isn’t whether to carry multiple lines, but how to strategically optimize portfolios that serve market needs while maintaining the deep expertise and manufacturer commitments that create value for all stakeholders.

_______________________________________________________________________________

About the author

Geoffrey Marlow is President of Marlow Advisory Group, providing strategic consulting to lighting industry professionals and manufacturers.

Additional articles by Geoff Marlow

AI in the Lighting Industry: Today’s Reality, Tomorrow’s Opportunity