Get a Grip Management Ceases Operations With NAILD; Transitions to New Management

Minneapolis-based Get a Grip Management (GAGM) has announced the conclusion of its management contract and the relinquishment of operational control for the National Association of Innovative Lighting Distributors (NAILD).

According to a press release issued by GAGM, “this transition marks the culmination of a vision that took a technically insolvent organization and transformed it into an elite, media-driven powerhouse. Over the course of its six-year tenure, GAGM utilized a cumulative $1.35 million (2019-2025) in management fees to systematically engineer and deliver a portfolio now valued at nearly $2.4 million in primary assets.”

GAGM stated “at the outset of the 2019 management term, NAILD faced the dual threats of insolvency and technical obsolescence. GAGM identified a core infrastructure that was non-functional and adrift, with a total starting asset valuation of just $119,378.00 — a figure composed primarily of the goodwill of a small, dedicated core membership. Over the subsequent six years, management executed a total digital and financial overhaul, converting those legacy liabilities and untapped potential into the nearly $2.4 million asset portfolio documented today.”

“We needed a miracle and we got one,” said Spencer Miles, who served as President during the 2019 transition. “Instead of just event planning, governance and bookkeeping, the typical skills that association management companies bring to the table, Get a Grip Management engaged with audio video producers, social media experts, software developers and along with the hard-core lighting knowledge of the members we brought NAILD back from the brink.”

The Revitalization: Operational Metrics

The GAGM tenure resulted in several reported operational shifts, largely driven by educational program and media development:

• Membership Growth: Total membership increased from 49 in 2019 to 116 in 2026. The distributor-tomanufacturer ratio moved from 1.35:1 to 5:1.

• Liquidity Position: GAGM reports a transition of $248,135.41 in cash and equivalents, a massive shift from the roughly $55,000 in cash inherited in 2019.

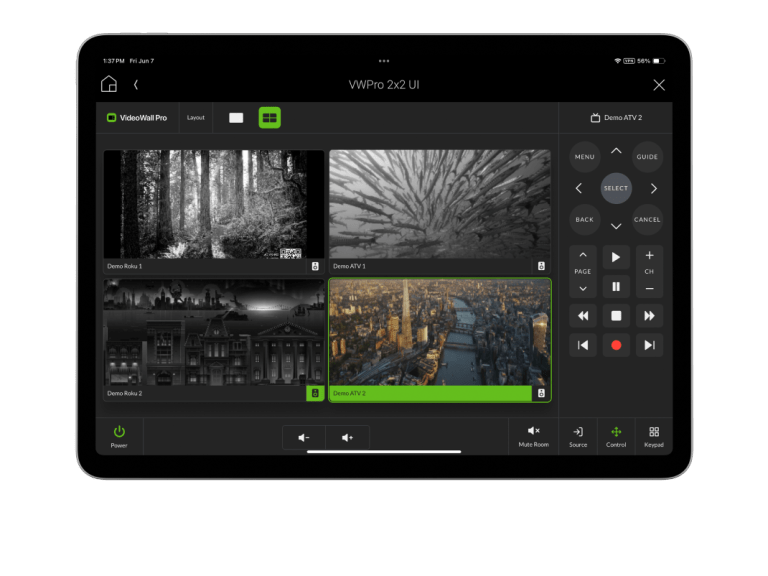

• Educational Infrastructure & Pedagogy Preservation: GAGM executed a total transformation of the association’s educational products, migrating legacy curricula to a custom, proprietary learning management system. This high-stakes “digital salvage” of the Paul Hafner Pedagogy rescued the association’s “Gold Standard” technical training from obsolete digital containers. This foundational work paved the way for a massive expansion of the educational portfolio, including the launch of LS Evolve (a library of 89 expert-led modular courses), the in-person LS-C (Lighting Specialist-Controls) certification, and the pioneering DR1 (Darkness Restoration 1) program. Collectively, GAGM values this modernized educational infrastructure and its turn-key revenue potential at $764,657.00.

• Media Stack & Industry Visibility: The association’s reach was expanded via the Lighting Industry News Brief (LINB) – which now commands a high-authority list of verified email subscribers maintaining a consistent 43% open rate – the Lighting Controls Podcast, and the award-winning Restoring Darkness series. GAGM values this integrated media ecosystem and its proven social reach assets at $728,040.00.

• Advocacy, Industry Standing & Goodwill: In non-profit management, an association’s primary asset is its collective influence and “goodwill.” Under GAGM’s leadership, NAILD established a formidable role as an active industry watchdog, providing distributor-led perspectives on national standards like DLC 6.0, sustainable fixture design and light pollution mitigation. This newly engineered industry presence, coupled with the establishment of the formalized “Think Tank” committee structure, has built the association’s social capital and institutional relevance from the ground up. GAGM values this accumulated Goodwill – the essential trust and influence required to be a leading voice in the sector – at $525,000.00.

Operational Transition

As operations moved to new management, GAGM presented a defensible enterprise valuation of almost 2.4 million. While incoming leadership has declined to comment on specific asset valuations – focusing instead on future operational goals – GAGM insists that the scale of this transformation represents a staggering value swing, leaving behind a debt-free, high-velocity engine that has effectively redefined the association’s future.

“I don’t really care about accounting for asset values,” added Cory Schneider, Immediate Past President during the 2019 transition. “Bottom line is we got a lot done. New Leadership inherits a vibrant and surplus association guaranteed to celebrate its 50th anniversary and that looked impossible in 2019.”

For matters involving the intellectual property, educational development, industry advocacy and media production utilized during the turnaround, readers are referred to the independent authoring and development firm, Get a Grip Studios Inc., based in Toronto, Canada.