Single-Family Starts Were Higher in July, Here’s Help to Boost Builder Business

According to an announcement the National Association of Home Builders (NAHB) made on August 19 – citing a report from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau – single-family housing starts experienced a modest gain last month. Before you break out the champagne flutes, there are other factors you should know: builders maintain that affordability continues to be an obstacle in completing home sales, and labor shortages and increased construction costs are further hampering momentum.

While overall housing starts increased 5.2% in July to a seasonally adjusted annual rate of 1.43 million units, according to that recently released report, a significant portion of that gain can be attributed to strength in the multifamily sector.

Also, when you read the fine print: the July reading of 1.43 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months — and so far, consistency hasn’t been a strong suit this year. According to the NAHB, within that overall number of starts, single-family increased 2.8% to a 939,000 seasonally adjusted annual rate, but is down 4.2% on a year-to-date basis. The multifamily sector, which includes apartment buildings and condos, increased 9.9% to an annualized 489,000 pace, the NAHB stated.

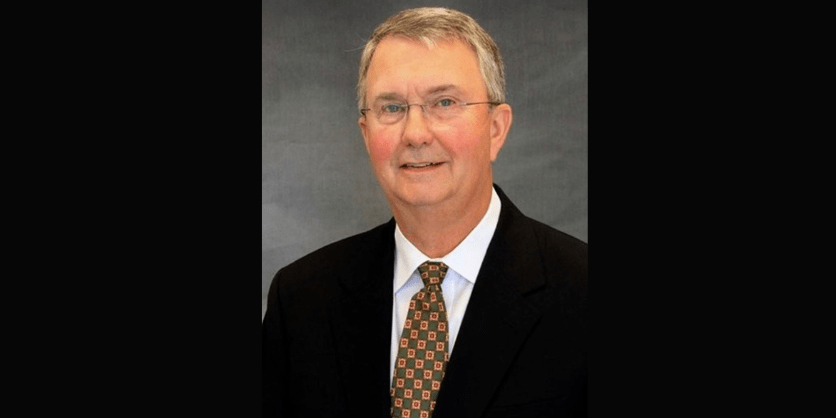

“Single-family production continues to operate at reduced levels due to ongoing housing affordability challenges, including persistently high mortgage rates, the skilled labor shortage and excessive regulatory costs,” said Buddy Hughes, chairman of the NAHB and a home builder and developer from Lexington, N.C. “These headwinds were reflected in our latest builder survey, which indicates that affordability is the top challenge to the housing market.”

“The slowdown in single-family home building has narrowed the home building pipeline,” said NAHB Chief Economist Robert Dietz. “There are currently 621,000 single-family homes under construction, down 1% in July and 3.7% lower than a year ago. This is the lowest level since early 2021 as builders pull back on supply.”

On a regional and year-to-date basis, combined single-family and multifamily starts were reported as 10.2% higher in the Northeast, 17.7% higher in the Midwest, 2.4% lower in the South and 0.5% lower in the West.

And while overall permits decreased 2.8% to a 1.35-million-unit annualized rate in July, single-family permits increased 0.5% to an 870,000-unit rate — but are down 5.8% on a year-to-date basis. Similarly, multifamily permits decreased 8.2% to a 484,000 pace.

Business consultant David Gordon, founder of Channel Marketing Group and publisher of Electrical Trends and US Lighting Trends, imparted some advice for lighting distributors.

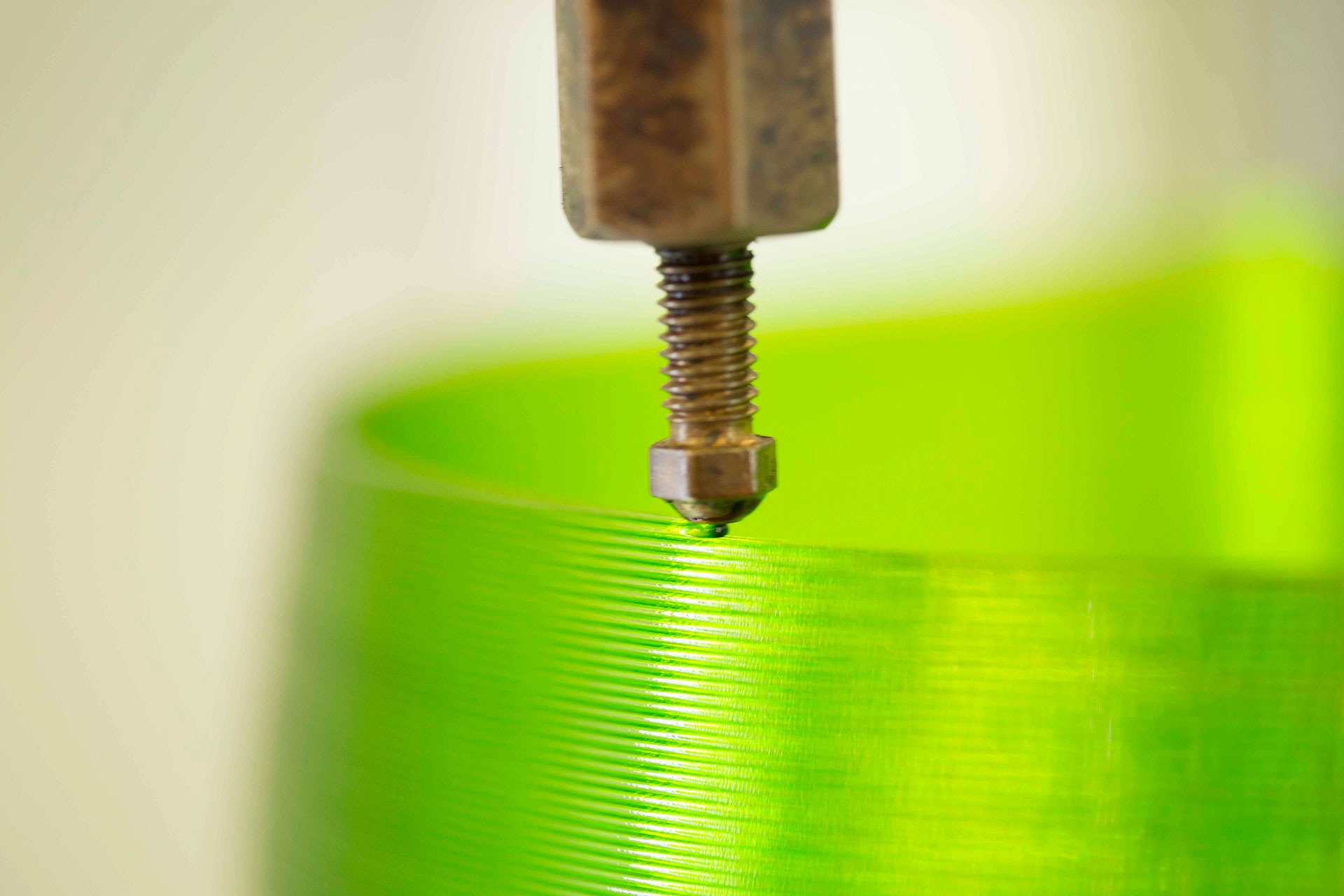

“If you are a showroom or an electrical distributor with a focus on the residential market, growth will come from identifying ways to sell upgrades through your builder, if they are willing. This means getting to the buyer so that they want the functionality of a product, the aesthetic of the item, or the technology (smart home, lighting controls, shades, landscape lighting, additional outlets in eaves, etc.),” he said.

Lighting distributors have the opportunity to launch what Gordon calls, “a post-move-in campaign” to help with lighting fixture upgrade opportunities since the lighting budget is often one of the first areas to get downsized in a builder package. “Maybe [you reach out to homeowners] right after move-in, or maybe it is 6-12 months after. This can be more of a direct marketing/telemarketing effort and doing some ‘show and tell,’” he advised.

For distributors who haven’t worked heavily with builders before – perhaps interior designers and consumers are their forte – this may be the time to become better aligned with a local custom builder. “How can you provide additional value through SPAs, storage, JIT shipping, working with their preferred contractor, and helping the contractor buy better or more conveniently (perhaps kitted by home and a “one-click” order on your website)?,” Gordon suggested, adding, “Target your opportunities and be hyper-focused and agile. If interest rates decline, there could be localized growth spurts. If your market gains a new major employer, that could spur residential growth. Be vigilant, be creative, but also be lean.”