2025 Q3 Pulse of the Lighting Market … Very Slow But Steady

Over the past couple of weeks, we’ve solicited the industry input into the pulse of the lighting industry in Q3. We had heard, nationally, and on average, that business was challenging, and, for the most part, that’s what the results came in as.

Highlights Included:

- Low / no single digit growth, inclusive of price increases that were announced due to tariffs

- Essentially the price increases did not hold or business was down significantly

- The end result appears that unit volume declined to off-set any realized price increases

- There are companies that did have success, with some having double digit quarterly increases. Whether this is due to winning some projects, shipping projects, winning business using material warehoused prior to the announced tariffs, or because companies potentially having a pricing advantage due to Made in America or products conforming to USMCA, is unknown … and it could be any or all of these

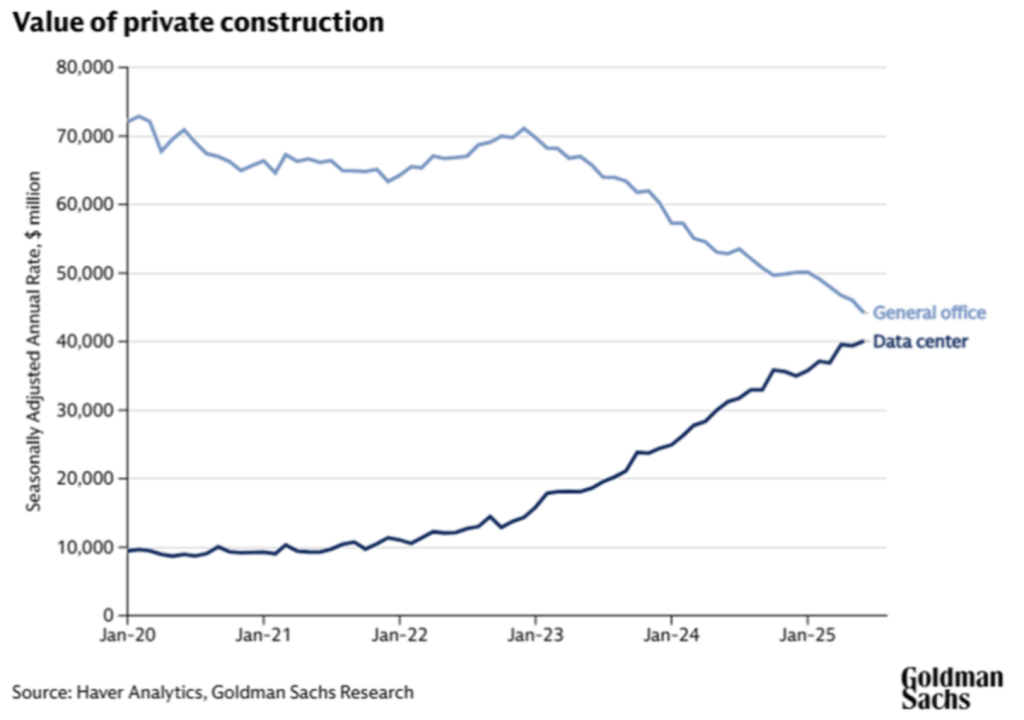

- The essence is that the construction market isn’t growing to sustain new projects and the renovations are not occurring at a pace to absorb the new construction downturn. As Goldman Sachs highlights in this chart, data centers, which were part of the private commercial construction data, are excluded, data centers are growing while commercial construction declines … and guess which has more lighting that gets installed

- Q4 is projected similarly, albeit perhaps a little improvement, according to distributors, due to end of year projects, and probably, for some, capturing utility rebate-induced projects. Further, there may be a “tariff overhang” that impacts Q4. This could relate to market paralysis due to uncertainty, tariffs rising or falling (perhaps due to legal efforts, negotiations, or new tariffs on finished material or components)

- Distributors commented that Q3 was “bid, to rebid, to bid again,” all with customers hoping for declines. Distributors that excel at value-engineering, either internally or partnering with preferred reps / lighting agents, are able to win and take some share

- We heard things such as:

- “Demand is slowing”

- “DOGE impacted business between layoffs, GSA cutbacks” and then others commented about budget cuts affecting hospital and education construction.

- Tariffs, “uncertainty”, and interest rates

- Once projects are won, and submittals shared, releases are slow to come

- Almost half of specifiers are “concerned or see future activity slowing” 6 months from now according to manufacturers and reps / lighting agents. This is more an indication of “significant” projects

- All report mid-single digit price increases during the quarter and uncertainty remains for Q4 on what will happen with tariffs given that there is no finality regarding China and India and some manufacturers shared they have worked through their pre-tariff acquired inventory (finished goods and/or components) and may announce price increases

Overall, while there is uncertainty in the market, it was a “steadying” quarter. Challenging. To learn more and obtain the report for only $35, click here.