Bringing the Light Back Home: A Reshoring Playbook

By Geoff Marlow, President, Marlow Advisory Group

Here’s the uncomfortable reality for commercial lighting manufacturers in 2025: the supply chain model that worked for two decades is fracturing, and the tariff math keeps shifting beneath your feet.

U.S. tariffs on Chinese imports have swung wildly this year — with effective rates on lighting components ranging from 35% to over 100% depending on timing and product category. According to Penn Wharton Budget Model analysis, China now faces effective tariff rates approaching 40%, the highest among major trading partners. Meanwhile, 25% duties on Canadian and Mexican imports have disrupted cross-border assembly operations that major lighting companies built over decades. The landed cost of that offshore luminaire has climbed significantly, and for an industry where margins were already compressed, that’s not a rounding error — it’s a strategic crisis.

But crisis creates opportunity. And the question I’m hearing from lighting executives across the country isn’t whether to consider domestic production — it’s how to make the economics work. After 30 years in this industry – including founding and scaling a lighting business from $27 million to $110 million and leading sales and marketing for the largest lighting and controls manufacturer in North America and one of the world’s leading lighting-system companies – I’ve never seen a moment with more strategic upside for those who move decisively. I’ve learned that the answer depends entirely on what you’re making and who you’re selling it to.

The Commercial Lighting Landscape Has Shifted

The U.S. LED lighting market represents a substantial opportunity — Mordor Intelligence estimates it at $19.2 billion in 2025, growing to $23.5 billion by 2030. Commercial applications represent roughly half of end-use demand, according to Grand View Research.

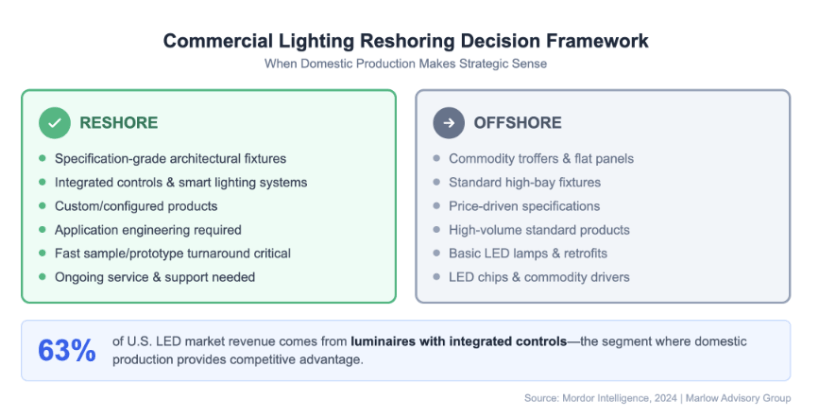

Here’s what matters strategically: luminaires with integrated controls now capture over 63% of the U.S. market by revenue, per Mordor Intelligence analysis. The commodity LED lamp business is a race to the bottom. The real value – and the real margin – lives in specification-grade fixtures with networked controls and smart building integration.

This shift changes the reshoring calculus entirely.

The 2024 International Energy Conservation Code, published last August by the International Code Council, expanded mandatory lighting control provisions for commercial buildings. It now requires occupancy sensors, continuous dimming capability, and automatic shutoff controls across most space types — making controllable fixtures virtually mandatory for code compliance. Meanwhile, states are accelerating beyond federal requirements: California banned most fluorescent tubes effective January 2025, following Vermont’s 2024 phase-out and similar legislation in Colorado, Rhode Island, and Oregon. Architects are specifying luminaires that bundle sensors and networked drivers because that’s how their projects meet requirements. When your product is a commodity troffer competing on price, offshore wins. When your product is a configurable, code-compliant lighting system requiring application engineering and rapid customization — the calculation flips.

Where Reshoring Actually Works in Lighting

Let me be direct: not everything in the lighting value chain belongs in the U.S. LED chips will continue coming from Asia — that supply chain infrastructure took decades and billions to build. But final assembly, controls integration, and customization? That’s where domestic manufacturing creates real competitive advantage.

Consider the specification lighting business. When an architect specifies a custom linear pendant for a Class A office lobby, they need samples in weeks, not months. They need engineering support in the same time zone. They need confidence that the fixtures arriving on site will match the approved sample exactly. Try delivering that from Shenzhen with a 12-week ocean freight lead time.

The domestic advantage becomes even more pronounced with controls. According to industry research, smart sensors and connected lighting solutions now influence over 40% of new commercial and industrial facility lighting installations in developed regions. These products require configuration, commissioning support, and ongoing software updates. They integrate with building automation platforms and compete for IT infrastructure dollars. The technical support requirements alone make a compelling case for keeping that capability close to the customer.

Here’s a practical framework: if your product requires application engineering, customization, or integration support, domestic assembly makes strategic sense. If you’re competing purely on unit price for commodity specifications, you’re fighting a battle where labor arbitrage still matters — and domestic production will struggle.

The Hidden Costs That Offshore Manufacturers Ignore

Most lighting companies evaluate sourcing decisions based on piece-part cost, landed cost, and maybe lead time. They’re looking at perhaps 40% of the actual picture.

What gets buried in overhead? Inventory carrying costs from 12-week lead times. Expedited air freight when a project timeline compresses. Quality inspection labor and third-party testing. Engineering time spent on specification clarifications across time zones. Warranty claims from fixtures that don’t match approved submittals. And the opportunity cost of losing the next project because you couldn’t deliver samples fast enough.

The Reshoring Initiative’s Total Cost of Ownership Estimator – which tracks approximately 30 distinct cost factors – demonstrates that 20-30% of imported products would actually be cheaper to source domestically when you account for everything. Harry Moser, founder of the Reshoring Initiative, has documented this repeatedly: companies using only FOB price or landed cost in their sourcing decisions are miscalculating by 20-30%. In the specification lighting business, where customization is constant and timelines are compressed, that gap runs even wider.

I worked with a lighting manufacturer who had been sourcing architectural fixtures from Asia for years. When we mapped their true costs – including the engineering resources consumed managing overseas production, the inventory buffer they maintained against lead time variability, and the margin they surrendered on rush orders – offshore was costing them significantly more than the purchase orders suggested. They moved final assembly to the Southeast and will recover that margin within 18 months.

Making the Numbers Work: Automation Is Non-Negotiable

Here’s where most reshoring conversations in lighting go wrong: executives compare U.S. labor rates to Asian labor rates and conclude domestic production is impossible. That’s the wrong comparison. The right comparison is U.S. labor rates against U.S. automation costs — because any domestic lighting facility built today should assume significant automation from day one.

Industrial robot costs have declined substantially over the past decade — from roughly $46,000 in 2010 to approximately $27,000 by 2017, according to ARK Invest analysis. Today, collaborative robots start around $25,000 for basic applications, with full industrial systems running $50,000 to $150,000 depending on complexity and integration requirements. Typical payback periods range from 12-24 months through reduced labor costs, improved throughput, and better-quality consistency.

For lighting assembly specifically, automation excels at high-volume, repetitive tasks: LED module insertion, driver mounting, wire termination, and final testing. A study by Deloitte and The Manufacturing Institute projects 2.1 million manufacturing jobs will go unfilled by 2030 — a skills gap that could cost the U.S. economy $1 trillion annually. In lighting, the skilled labor shortage is already acute. Automation isn’t about eliminating workers — it’s about producing at all while preserving skilled positions for tasks that require human judgment: quality inspection, custom configuration, and technical support.

Smart lighting systems command significant price premiums over basic LED fixtures — the additional features, engineering, and support requirements justify higher margins. If your automation investment enables you to capture more of that high-value segment with domestic production, the payback math becomes compelling.

The Controls Advantage: Software Changes Everything

The real transformation in commercial lighting isn’t happening in the fixture — it’s happening in the controls. Networked lighting systems that integrate with building automation, enable energy tracking, and support occupancy analytics are where the growth is. The smart lighting market is projected to reach $56.6 billion globally by 2030, according to Mordor Intelligence, growing at nearly 20% annually. And this creates a natural reshoring opportunity that most lighting manufacturers haven’t fully recognized.

Controls development is inherently a domestic function for most U.S. manufacturers. Your software engineers are here. Your integration partners are here. Your commissioning teams are here. When controls represent a growing share of your product’’ value – and increasingly, they represent the majority of your differentiation – having final assembly close to that engineering capability makes strategic sense.

Consider the service model. A networked lighting system isn’t sold and forgotten — it requires ongoing support, software updates, and integration troubleshooting. When the fixture and the controls come from the same domestic facility, your support model simplifies dramatically. When they come from different continents with different quality systems and different communication protocols, every service call becomes an exercise in finger-pointing.

A Practical Reshoring Roadmap

If you’re evaluating domestic production for commercial lighting, here’s the approach I recommend:

Start with your highest-margin, highest-customization products. Specification-grade architectural fixtures, integrated controls systems, and made-to-order configurations are natural candidates. These products already command premium pricing, and customers are paying for responsiveness and quality — not just lumens per dollar.

Run a genuine total cost analysis using the Reshoring Initiative’s free TCO Estimator at reshorenow.org. Force your team to quantify the hidden costs they’ve been absorbing in overhead. The number that emerges will surprise you.

Design automation into your facility plan from the start. A domestic factory built around manual assembly will never compete. A domestic factory built around flexible automation, serving the high-value segments where speed and customization matter, absolutely can compete.

Consider the Southeast. Texas, the Carolinas, Georgia, and Tennessee continue leading reshoring activity — favorable costs, established logistics infrastructure, right-to-work environments, and aggressive state incentives make the region compelling.

Pilot before you leap. Move one product line. Measure everything. Learn what works before committing to a broader transition.

The Bottom Line

Commercial lighting is bifurcating. The commodity end – basic troffers, standard high-bays, price-driven specifications – will remain a global sourcing game where labor arbitrage matters and domestic production struggles to compete.

But the growth is elsewhere. Connected luminaires, integrated controls, specification-grade products requiring customization and application engineering — this segment rewards responsiveness, quality, and technical capability over raw cost. Tariff volatility accelerates the math, but the underlying strategic logic holds regardless.

The lighting manufacturers winning right now aren’t the ones with the lowest piece-part costs. They’re the ones who understand which products belong where — and have built supply chains that deliver speed, flexibility, and margin where it matters most.

Reshoring isn’t the answer for everything. But for the right products and the right strategy, bringing the light back home makes more sense today than it has in decades.

About the Author

Geoff Marlow is President of Marlow Advisory Group, bringing the perspective of a senior leader, founder, and successful exit entrepreneur. He provides strategic consulting, leadership training, and public-speaking services, advising manufacturers on market strategy, operational transformation, and competitive positioning.

Additional articles by the author

Why Specifications Matter: The Hidden Cost of Compromise

Why Lighting Reps Carry So Many Lines: Understanding the Multi-Line Strategy in Today’s Market

AI in the Lighting Industry: Today’s Reality, Tomorrow’s Opportunity