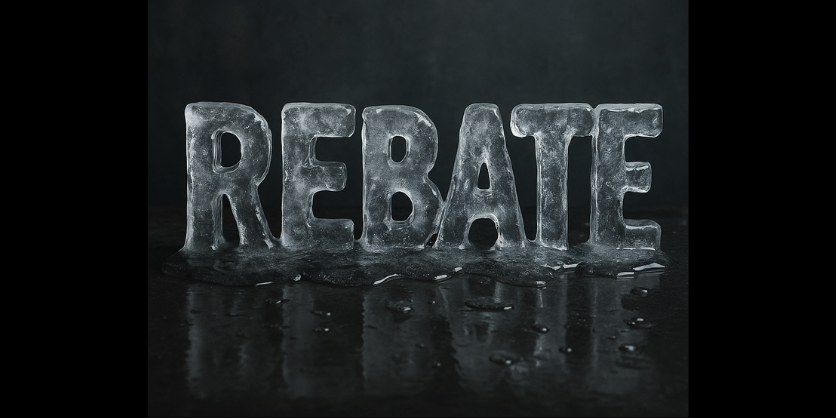

Are Rebates Disappearing or Merely Evolving?

The adage, “Don’t sell rebates, sell outcomes” easily applies to the current landscape in the electric utility market today. With the sunsetting of some utility rebate programs – such swapping out incandescent, fluorescent, metal halide, and high-pressure sodium for LED versions on a lamp for lamp basis – many contractors, lighting specifiers, and facilities managers have been shifting their focus to rebates for expanded programs that involve networked lighting controls, whole-building commissioning, and HVAC controls.

With that in mind, instead of referring to a specific monetary rebate during the sales process, a better strategy would be to emphasize benefits such as reduced operating costs and maintenance, improved lighting quality, safety, productivity, resilience, and future code compliance.

In short, there are still financial incentives from state, utility, and federal programs available for projects that involve more complex controls systems.

Last month MC Power outlined some of the initiatives for 2026 in the article Maximizing Savings in 2026: Incentives, Rebates & Tax Deductions for Commercial LED Lighting Retrofits.

“If your facility is considering a lighting upgrade, 2026 could be one of the last best years to take advantage of several major programs,” the article stated, citing:

1. Federal Tax Deduction: Section 179D (Available Through Mid-2026)

The Section 179D Energy Efficient Commercial Buildings Deduction remains one of the most impactful financial incentives for LED lighting retrofits in 2026.

What It Covers

179D allows commercial building owners to claim a tax deduction based on the building’s square footage when they install energy-efficient improvements — including LED lighting systems.

How It Helps

Depending on the level of energy savings achieved, businesses may qualify for deductions ranging from:

• Base level: approximately $0.60 per sq. ft.

• Enhanced level: potentially up to $5.00+ per sq. ft. when projects meet prevailing-wage and high-performance requirements

For larger commercial or industrial facilities, this deduction can represent tens or hundreds of thousands of dollars in tax savings.

Important 2026 Deadline

Due to federal policy changes, projects must begin construction before June 30, 2026 to qualify for 179D.

2. Utility Rebates for LED Lighting (Active Throughout 2026)

While federal incentives are tightening, utility rebates remain widely available in 2026 and continue to be one of the biggest cost-reducers for LED retrofits.

Most utilities provide:

•Per-fixture rebates for LED high bays, troffers, tubes, wall packs, exterior fixtures, and more

•Rebates for lighting controls (occupancy sensors, daylight harvesting, dimming systems)

•Custom incentives based on watts reduced or energy savings achieved

These programs often offset 15 to 40% of total project cost — sometimes even higher for facilities that install advanced controls.

Note: Nearly all utilities require rebate pre-approval before materials are purchased or installed.

3. State & Local Incentive Programs (Varies by Region)

In addition to utility rebates, many states continue to fund:

•Energy-efficiency grants

•Low-interest financing

•Bonus lighting incentives

•Commercial building efficiency programs

These incentives vary significantly by state and funding cycle, but they remain an important resource for reducing LED retrofit costs in 2026 — especially for industrial, agricultural, and public-sector facilities.

4. Why 2026 Is a Strategic Year for LED Retrofits

With several federal provisions changing after mid-2026, this year is a critical window for businesses wanting to maximize savings.

Key reasons to act in 2026:

✔ 179D federal deductions remain available — but only until June 30, 2026

✔ Utility rebates are strong and widely available nationwide

✔ LED pricing is highly competitive, making ROI stronger than ever

✔ Energy savings stack year over year, reducing operating costs immediately

✔ Better lighting improves safety, productivity, and employee comfort

For many commercial and industrial properties, a 2026 LED upgrade delivers a typical 1- to 4-year payback when incentives are applied.

Related articles

Are You Taking Advantage of the Smart Building Utility Rebates Available?